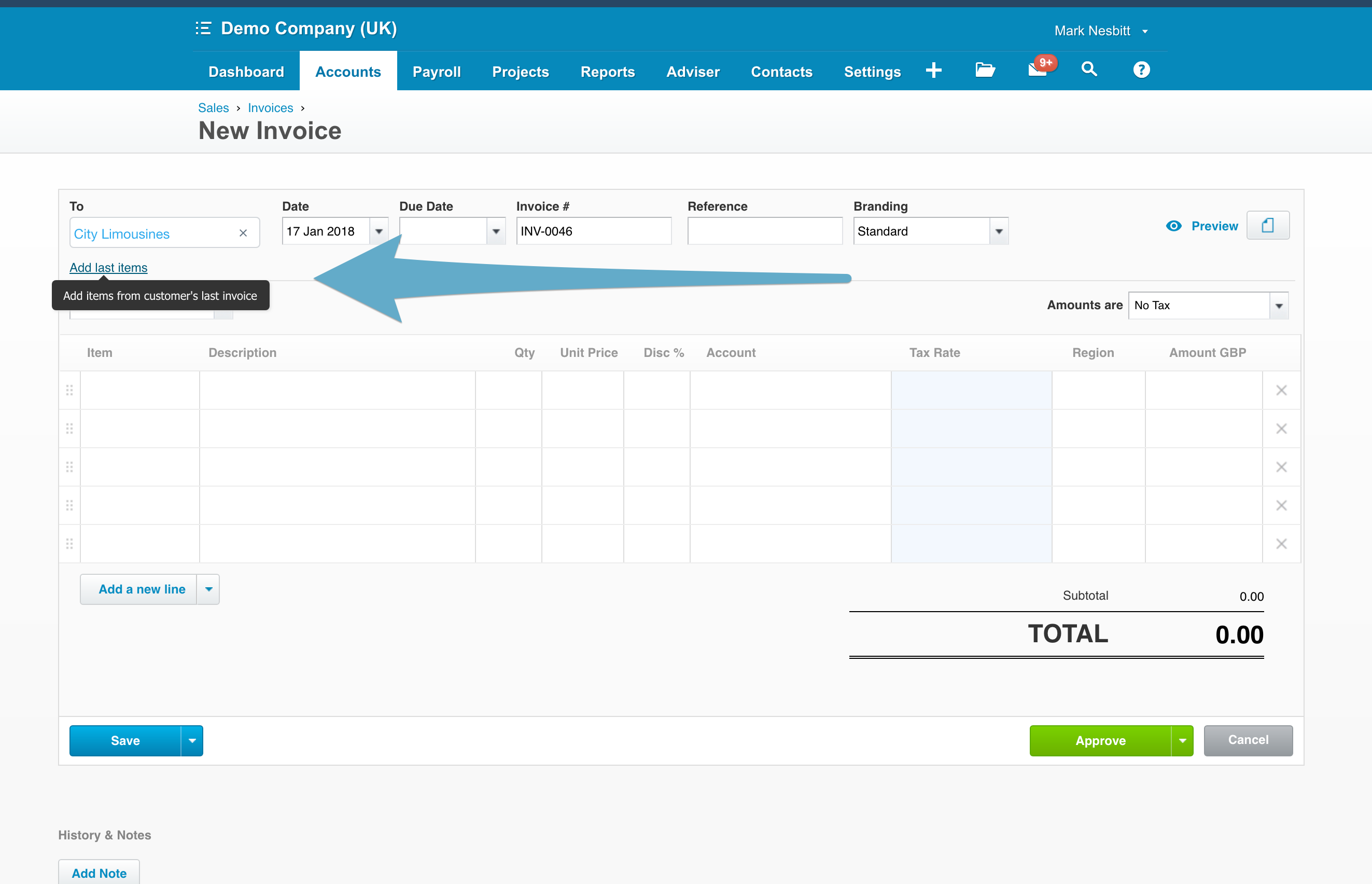

This gives you greater control over your cash and a better view of your business. The very nature of online invoicing means that you can view this data wherever you are and from any device and some of those top-level reports are even available on the app. Once you’ve sent invoices from Xero they go into your reporting system so that at any point you can see what’s due, what’s overdue, and how much you’ve invoiced (amongst many other great report options). None of this takes much time and the repeating invoices saves you hours every month and ensures you never forget to send one (yes, plenty of our clients tell us they’ve accidentally missed invoices here and there). The invoice will land in the inbox of your client after you’ve forgotten you even created it. Xero will allow you to create an invoice as soon as you’re ready to and then set a date for the invoice to go out. How many times have you started some work for a customer but didn’t want to invoice right away but you know you need to invoice them in say a week from the start of the project? Invoices are completely customisable including the editable template and the payment due date and payment terms, which you can edit once on the repeating invoice and send forever more! Xero has a repeating invoice function so you can set up a repeating sales invoice.

Xero enables you to create invoices on-the-move too from their brilliant app so you can invoice a client right there and then and in many instances get paid right away too! Now you don’t need to wait for a bookkeeper to create the invoice and with recurring invoices you don’t need to send them at all – it just does it for you. Online invoicing helps you ask for money more quickly. If you’re creating invoices in Excel, Word or anywhere else then you might want to read on because the benefits to online invoicing are really exciting and will transform your invoicing, cash flow, and credit control.

XERO INVOICING PLUS

One of the key changes will be arguably one of cloud accounting’s biggest plus points – online invoicing! With this change comes many questions for businesses but these ‘forced’ changes will likely benefit them.

Making Tax Digital (MTD) becomes mandatory for VAT registered business on the 1 st April 2019 and we covered the areas you’ll need to consider in our recent MTD blog. At Trinity Accountants we think it’s the right way to go and it comes with so many positives. Accounting is moving to the online world whether we like it or not.

0 kommentar(er)

0 kommentar(er)